unemployment income tax refund calculator

This way you can report the correct amounts received and avoid potential delays to. There are also many organizations in each county that will prepare and file your return for you.

On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in 2020.

. Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

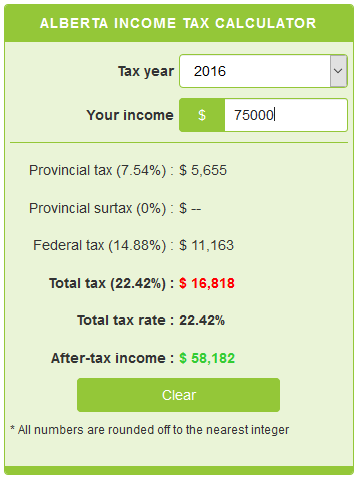

This tax return and refund estimator is currently based on 2021 tax year tax tables. Were here for more than calculating your estimated tax refund. Estimate your tax refund with hr blocks free income tax calculator.

Effective tax rate 150. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

575 on taxable income. The only way to see if the IRS processed your refund online is by viewing your tax transcript. A few years ago as the Great Recessions effects started being felt Congress in 2009 decided to make up to 2400 in.

Visit IRSgov and log in to your account. Heres how to check online. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. There are several ways to have your income tax return prepared for you free as outlined below. Unemployment benefits are taxable income.

Generally unemployment compensation is taxable. Calculate what your weekly benefits would be if you have another job. That info is not quite an urban legend.

See What Credits and Deductions Apply to You. You must file Schedule 1 with your Form 1040 or 1040-SR tax return. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file.

May not be combined with any other promotion including Free 1040EZ. To calculate your weekly benefits amount you should. Work out your base period for calculating unemployment.

Filing with us is as easy as using this calculator well do the hard work for you. This means they dont have to pay tax on some of it. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

However this unemployment tax break applied only to 2020 tax returns. Paying tax on unemployment. Up to 10 cash back TaxSlayer is here for you.

Unemployment benefits are included along with your other income such as wages salaries and bank interest For tax year 2020 the first 10200 of unemployment income were tax free for taxpayers with an AGI of less than 150000. If you havent opened an account with the IRS this will take some time as youll have to take multiple steps to confirm your identity. The IRS Free File program makes tax software programs available to eligible taxpayers for free.

It is mainly intended for residents of the US. Calculate the highest quarter earnings with a calculator. The total amount of income you receive including your unemployment benefits and your.

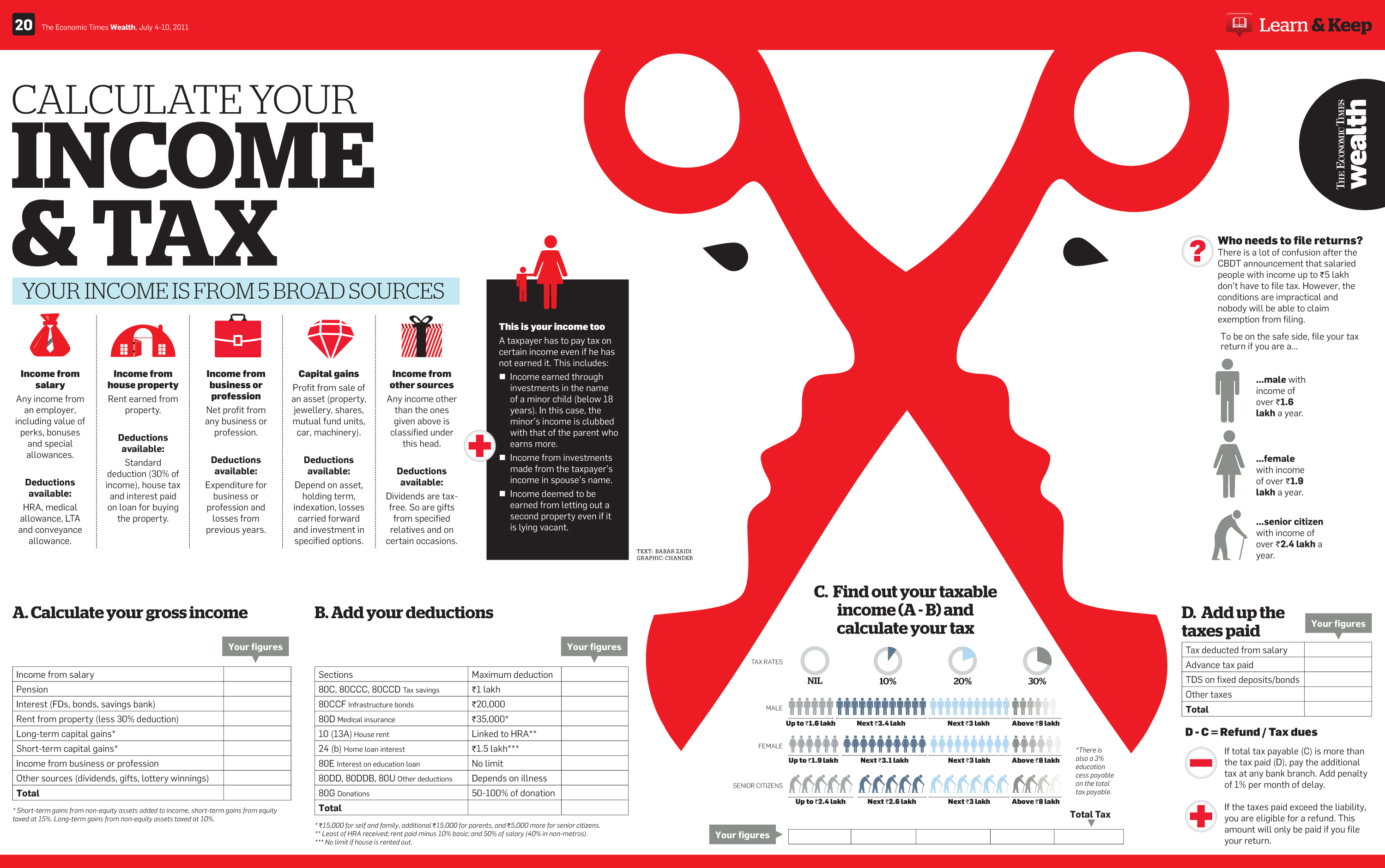

The employer should calculate and withhold proper income taxes based on the withholding status declared by the employeebut ultimately correct payment of income taxes is the individual employees responsibility and any under or overpayment of taxes will be theirs to resolve when they file their tax return. Before we jump to your questions you may want to see how your unemployment income will affect your taxes. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Individuals should receive a. Eligibility for unemployment insurance benefit amounts and the length of time benefits are available are determined by the State law under which unemployment. Ad Determine Your Eligibility.

Simply select your tax filing status and enter a few other details to estimate your total taxes. State Income Tax Range. 2 on up to 3000 of taxable income.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or. This calculator is perfect to calculate irs tax estimate payments for a. There are no taxes on unemployment benefits in Virginia.

This handy online tax refund calculator provides a. More than 6 months Also lived in California more than 6 months in 2020 Are at least 25 years old but under. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Learn how long tax refunds take. You heard some unemployment is tax-free. Choose TaxSlayer and get your maximum refund and 100 accuracy guaranteed.

Maximizing Stimulus Refund Checks Is All We Do. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The Free File software programs will help you.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. Citizen or resident alien and have a valid Social Security Number File taxes with an ITIN Individual Taxpayer Identification Number Tax filers with an ITIN may now qualify for the CalEITC and the Young Child Tax Credit YCTC During 2020 lived in the US. Use this 2021 Tax Calculator to estimate your 2021 Taxes.

Ad Enter Your Tax Information. The IRS has identified. Another way is to check your tax transcript if you have an online account with the IRS.

Employer Retention Tax Credit CPA Firm. Heres what you need to know. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income.

And is based on the tax brackets of 2021 and 2022. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. State Taxes on Unemployment Benefits.

Take a look at the base period where you received the highest pay. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

Calculate your unemployment benefits for. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. Use The Most Accurate Employer Retention Tax Credit Calculator.

But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic. Unemployment income Tax calculator help. Tax impact of benefits.

Income Tax Calculator For India Visual Ly

![]()

France Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Blue Springs Tax Preparation For Business Owners Your Tax Preparation Needs Are As Individual As You Are Alliance Financi Tax Attorney Tax Lawyer Tax Refund

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

Income Tax Calculator 2021 2022 Estimate Return Refund

Self Employed Tax Calculator Business Tax Self Employment Employment

German Wage Tax Calculator Expat Tax

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Calculator De Taxe Germania Neotax

Jitendra Tax Consultants Is A Registered Tax Agent With Fta And Provide Tax Related Services Our Expert Team Gives Vat Registrat Tax Consulting Tax Accounting

Calculator De Taxe Germania Neotax

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

China S Individual Income Tax Everything You Need To Know

1 200 After Tax Us Breakdown June 2022 Incomeaftertax Com

Federal Tax Calculator Hot Sale 53 Off Www Turkishconnextions Co Uk

Vsu Vislovivsya Shodo Dovedennya Rozmiru Zbitkiv Zapodiyanih Vnaslidok Samovilnogo Zajnyattya Zemelnoyi Dilyanki Income Tax Audit Income Tax Return